In 2025, several major agencies that had previously worked exclusively with OnlyFans were forced to close or completely rethink their strategies. The reasons vary: growing competition, decreasing promotional efficiency, falling creator earnings, and declining audience trust.

At the same time, Fansly has been showing steady traffic growth and introducing tools that OnlyFans clearly lacks.

In this article, we’ll take a detailed look at both platforms, analyze their strengths and weaknesses, and explore real earning case studies.

Current Market Overview: 2025 Numbers and Trends

To understand where the industry is heading, it’s important to look at the bigger picture and the ongoing changes shaping it right now.

OnlyFans: Scale of the Leading Platform

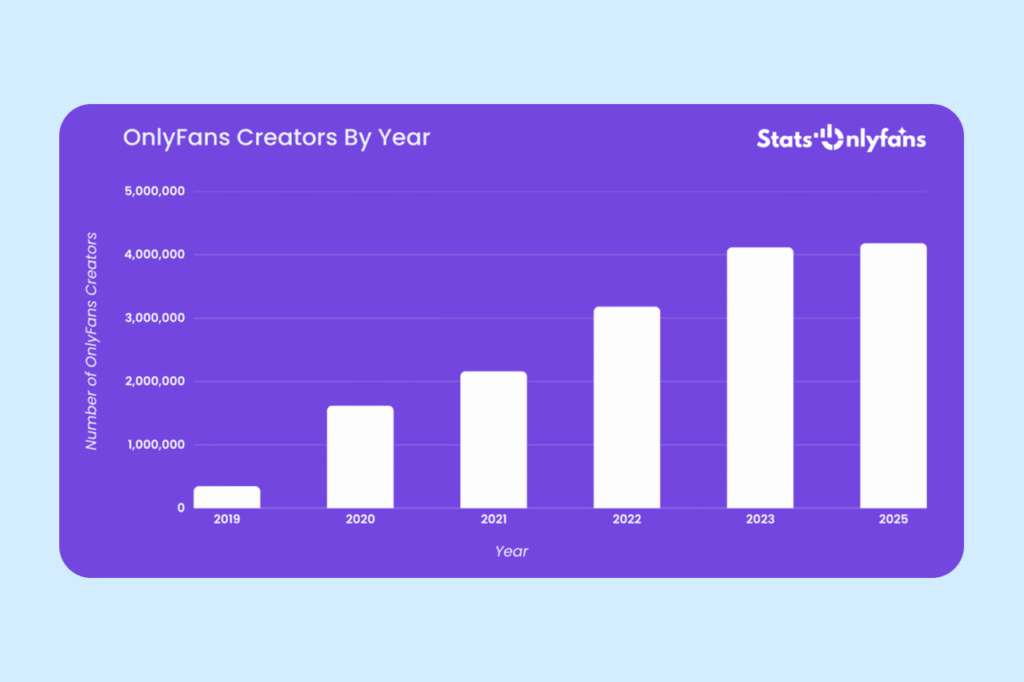

By 2025, OnlyFans has reached 305 million registered users and 4.1 million active creators, securing its position as the market leader.

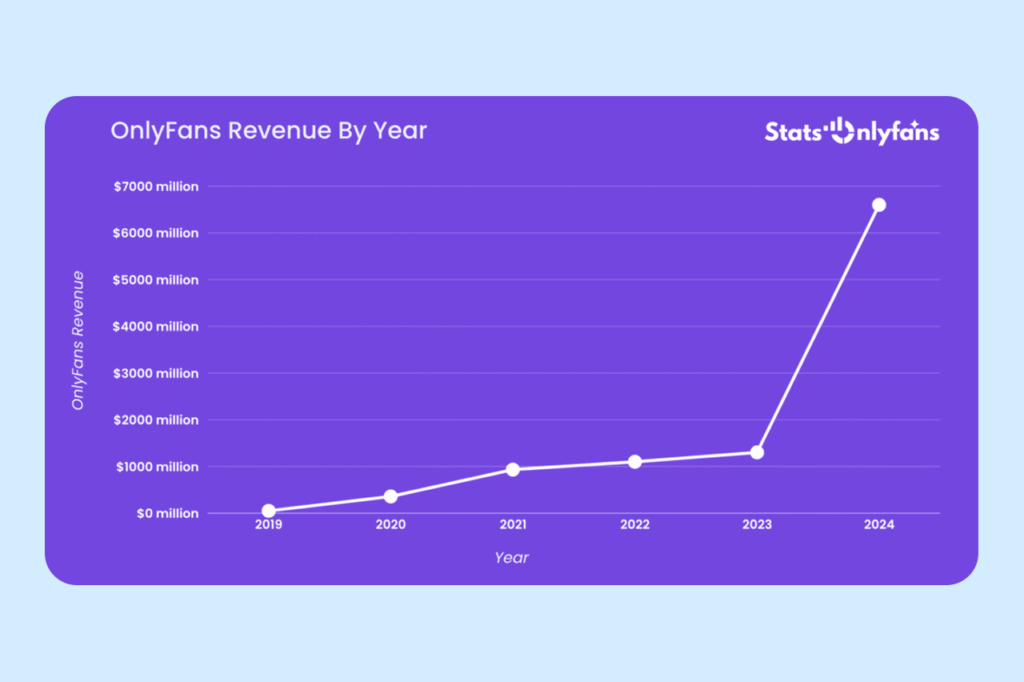

In 2024, creators on the platform earned $5.35 billion, which is 20% higher than the previous year. The platform itself generated $6.6 billion in total revenue.

Despite the impressive numbers and massive user base, it’s becoming increasingly difficult for creators to succeed on OnlyFans.

The platform has become oversaturated and far more competitive as the market expanded. The number of creators grew from 348,000 in 2019 to 4.2 million in 2024 — an increase of more than 1,000% in just five years.

It’s also important to note that audience distribution across creators is far from even. On average, a typical model has around 21 subscribers, while top creators attract tens or even hundreds of thousands of fans.

The average income remains modest — most creators earn between $150 and $180 per month. Meanwhile, the top 1% of creators capture 33% of the platform’s total earnings, and the top 10% account for about 75%.

An important trend: the average subscription price has increased to $12.40 per month in 2025, up 18% from 2023. This may signal a shift toward a more premium segment but also means the entry barrier for new subscribers is getting higher.

Fansly: How the Main Alternative to OnlyFans Is Growing

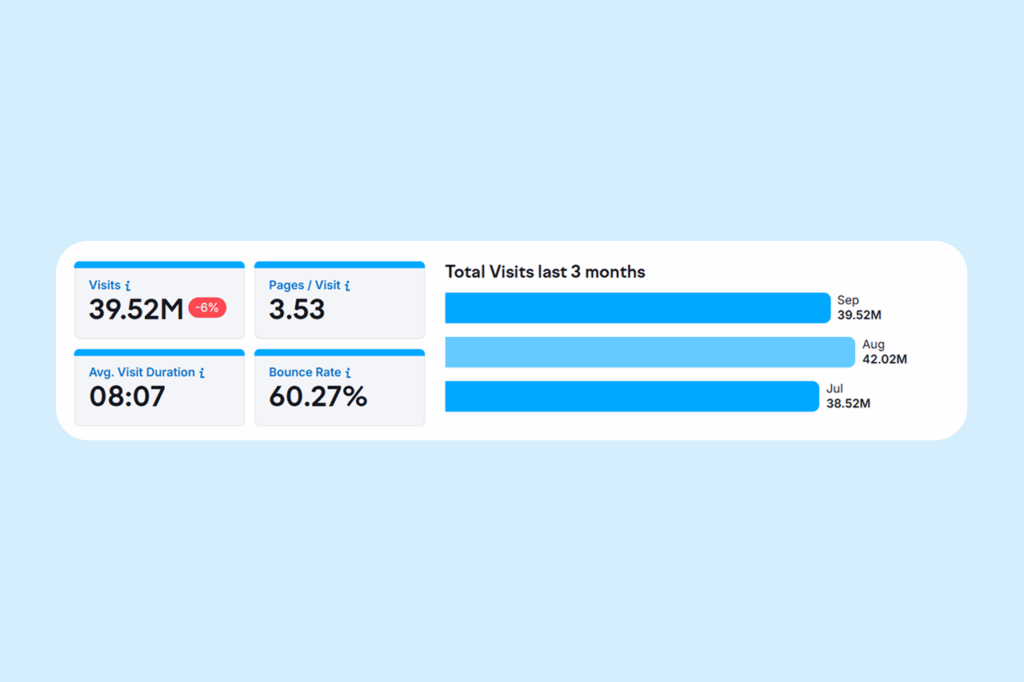

Fansly entered the market later than OnlyFans but is now rapidly gaining its share. The platform doesn’t disclose the exact number of models or creators, but what matters more is its traffic — which grew by 10% in August 2025, though it dipped slightly in September.

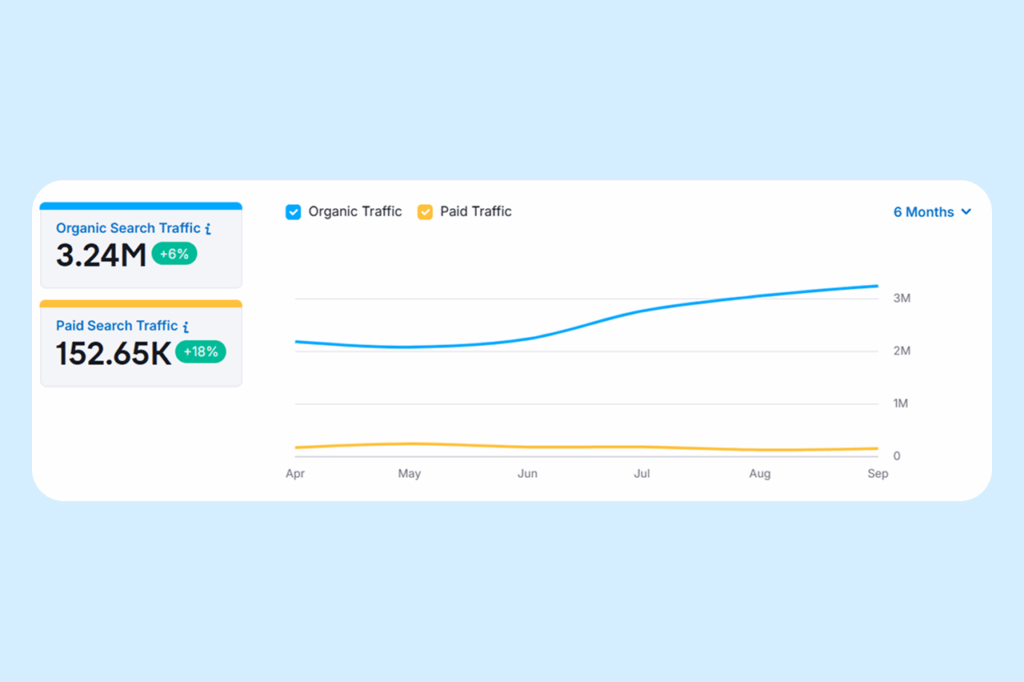

Fansly’s traffic in September increased by 6.24% compared to the previous month, reaching its highest level of organic search to date. In addition, paid search traffic grew by 18.13% compared to the previous month’s paid level.

The key difference with Fansly lies in its approach to working with creators. While OnlyFans provides the infrastructure but offers no real help with promotion, Fansly actively invests in tools designed for growth and scalability. These include:

- FYP recommendation systems

- Advanced analytics for creator accounts

- Responsive support services.

It’s important to note that despite its creator-friendly approach, content creators on Fansly generally earn significantly less than those on OnlyFans. The main reason is scale — OnlyFans carries far greater brand weight and public trust.

Industry-Wide Trends

Several major trends are shaping the creator economy in 2025:

- Audience skepticism due to AI automation. After widespread media coverage of chatters and AI bots, fans have become more cautious with their spending. Platforms that feel more authentic and personal are gaining a clear advantage.

- Intensified competition for attention on social media. Social platforms remain the primary source of traffic, but their algorithms have become increasingly strict toward NSFW content. Moderation has tightened, and strategies that worked well in 2020–2021 are no longer effective in 2025.

- The need for diversification. Relying on a single platform is now viewed as a major risk. Successful creators are expanding across multiple platforms to build stability and resilience.

These trends are shaping the future of the industry. Platforms with a more transparent, personalized approach are emerging as the long-term winners. It’s within this context that the choice between OnlyFans and Fansly should be evaluated.

OnlyFans: A Detailed Look at the Market Leader

Let’s take a closer look at OnlyFans — its strengths, drawbacks, and what working on the platform really means in 2025.

Key strengths of OnlyFans

Massive audience reach. With over 305 million registered users, the potential market is enormous. Even capturing a small share of this audience can translate into substantial income.

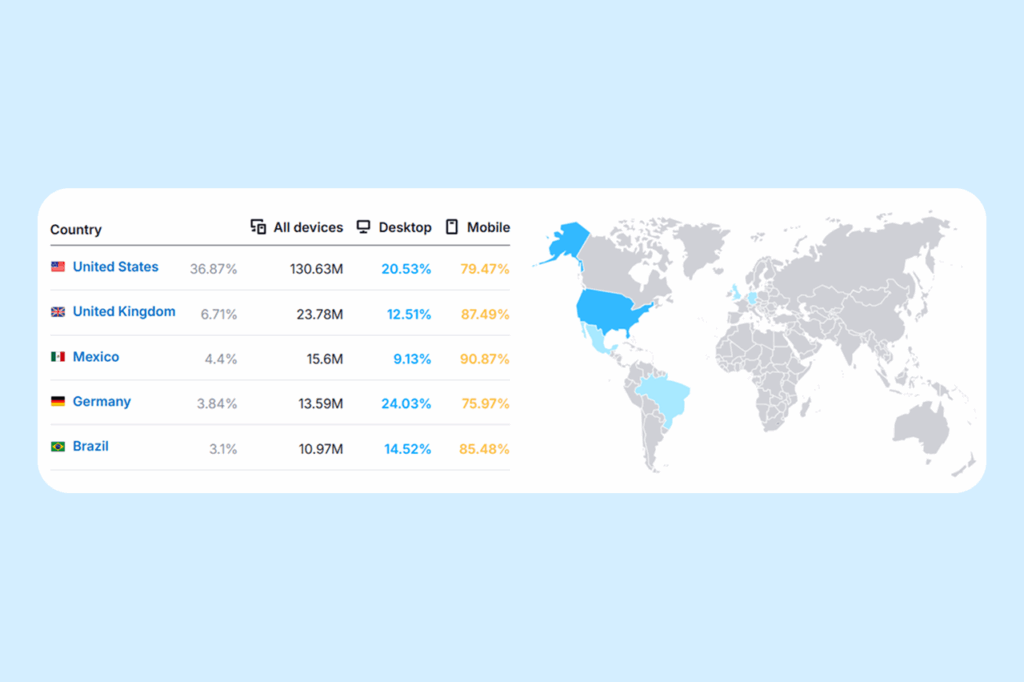

The primary audience for OnlyFans is concentrated in the United States, the United Kingdom, and Mexico.

Brand recognition. When you post a link to OnlyFans on Twitter or Reddit, users instantly know what kind of platform it is and what type of content to expect. This familiarity makes traffic conversion easier — there’s no need to explain what the service is or how it works. In many ways, OnlyFans has become synonymous with the entire industry.

Proven stability and reliability. The platform has been operating since 2016 and, over nine years, has demonstrated lasting resilience. Having paid creators $5.3 billion in 2023 alone, OnlyFans has proven it’s not just another startup that could disappear overnight. For models planning a long-term career, this stability is crucial.

Potential for high earnings. While the average income is modest, top creators earn remarkable amounts. Particularly inspiring are the stories of creators who built their careers entirely through OnlyFans without being famous actresses or singers.

- Gemma McCourt — $2.3 million per month with 102,800 subscribers paying $29 per month.

- Tana Mongeau — $3 million per month, having built her audience from scratch through YouTube.

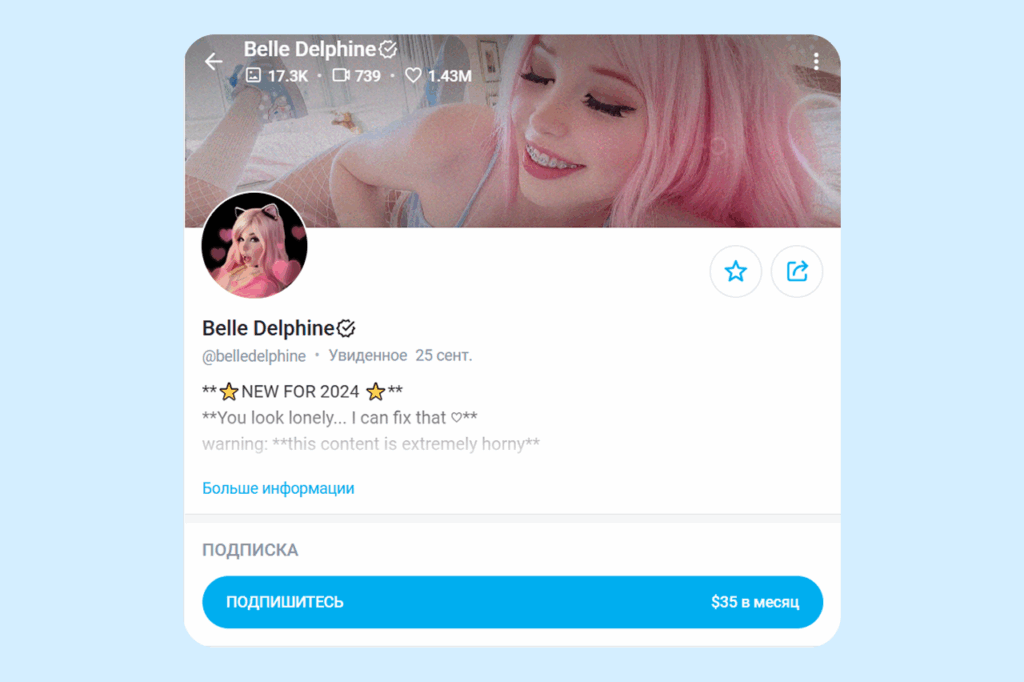

- Belle Delphine — around $960,000 per month with 60,000 subscribers in the cosplay niche.

Various monetization tools. OnlyFans offers several ways for creators to earn:

- Subscriptions

- Paid messages (PPV)

- Send a Tip (tips up to $200 available after four months on the platform)

- Live streams, and the option to sell merchandise.

The latter is especially valuable for creators who want to expand their brand beyond adult content and build additional income streams.

A wide range of payout options. OnlyFans supports bank transfers, e-wallets, Venmo, and Paxum. The minimum withdrawal amount is $20. Payments are processed within 3–5 business days after the standard seven-day holding period, providing predictable financial planning.

A developed ecosystem. Over time, OnlyFans has built a full-scale infrastructure for creators: management agencies, promotion services, training courses, forums, and online communities. This means new creators have access to a wealth of learning and growth resources. The collective experience of millions of models is already available and easy to tap into.

Weaknesses of OnlyFans

No internal traffic. This is the platform’s main issue. OnlyFans has no recommendation system, no internal category search, and no tools for organic discovery. In practice, it functions more like a hosting and payment gateway rather than a platform for audience growth.

Each subscriber has to be attracted externally through platforms such as:

- TikTok

This means creators must handle promotion themselves or hire a team, which adds extra costs.

Market saturation and high competition. Because of the huge number of creators, newcomers struggle to compete with experienced models. Only 36% of registration requests are approved, and even among those who get approved, most fail to succeed. The problem isn’t just the number of competitors — many niches are already completely filled with creators who have loyal audiences.

Uneven income distribution. The large user and creator base has led to an imbalance in earnings. Around 90% of creators share only a quarter of the platform’s total revenue. For most models, OnlyFans remains a source of additional rather than primary income.

Customer support issues. Many models report that tickets are handled by automated systems and reaching a real person is extremely difficult. When income depends on how fast problems are resolved, this level of support becomes a serious drawback.

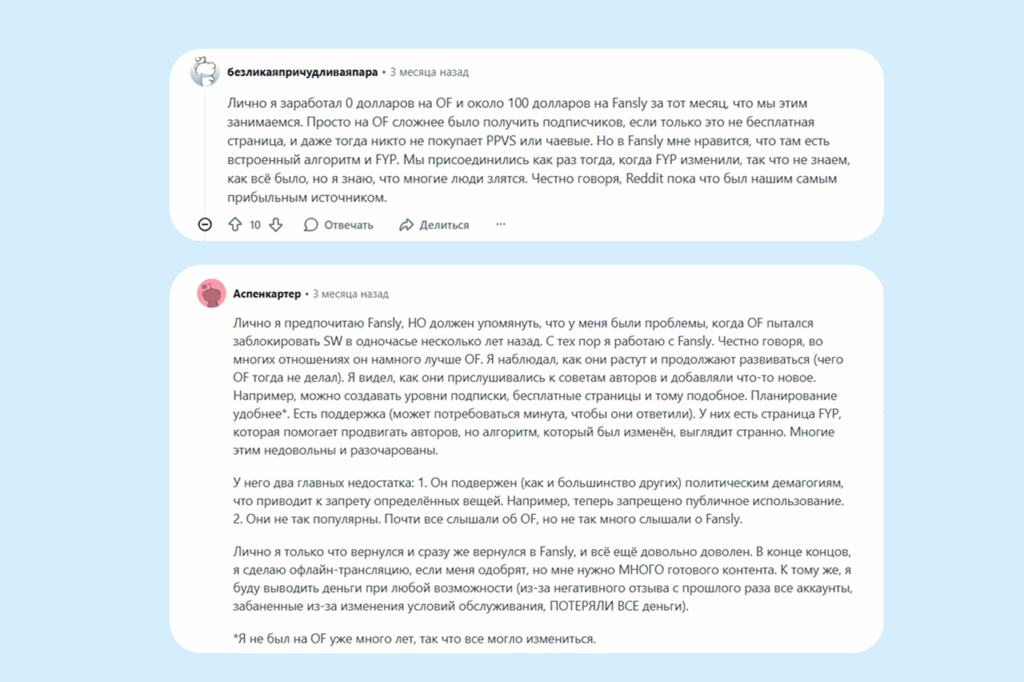

Many creators have shared their frustration on Reddit about how long it takes to get help from OnlyFans support. Some report waiting weeks for a reply to simple issues like payout errors or account verification. Others say their tickets are closed automatically without any resolution.

Unpredictable Content Policy. The platform’s attempt to ban explicit content in August 2021 made many creators question its reliability. Rules can change at any time under pressure from banks or regulators. Since then, OnlyFans has regularly removed content without clear explanations. Many creators also complain about inconsistent moderation — identical content might be approved for one model and deleted for another.

Decline in External Promotion Effectiveness. Back in 2020–2021, creators could attract 50–100 new subscribers a day from Reddit alone. By 2025, even 10–20 daily clicks is considered a good result. Competition has increased not only on OnlyFans itself but also across all external traffic channels.

Chargeback, Payment, and Withdrawal Issues. If a subscriber disputes a transaction with their bank (a chargeback), OnlyFans automatically deducts that amount from the creator’s balance, even if the content was delivered. In cases of multiple chargebacks, creators can end up with a negative balance and be forced to repay the platform. The protection system against fraudulent subscribers is weak. Additionally, there are ongoing complaints about payout delays, with several Reddit users reporting long waits and inconsistent payment processing.

Fansly: A Closer Look at the Fast-Growing Alternative

Let’s take a detailed look at Fansly — its advantages, drawbacks, and how the platform operates.

Strengths of Fansly

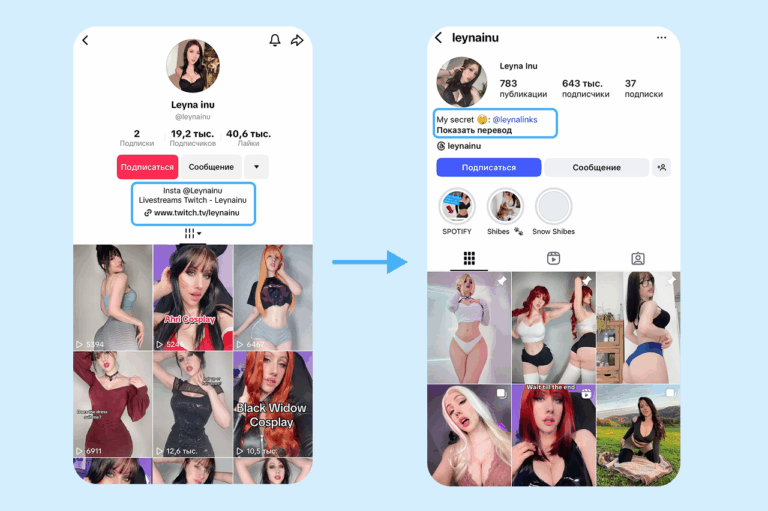

For You Page (FYP) Recommendation System. This is Fansly’s biggest and most important advantage over OnlyFans. The platform uses machine learning algorithms to deliver personalized recommendations, showing content to users based on their interests, viewing history, and behavioral patterns. For creators, this means access to organic traffic directly from within the platform.

For example, one creator shared that she earned $17,325 in just three months using only SFS traffic and internal FYP recommendations — without a single post on Reddit or Twitter.

Less competition. With 130 million users and fewer creators, it’s easier to stand out and build an audience on Fansly. Since the platform is still in its growth phase, early adopters gain a significant advantage. This may change within the next two to three years, but for now, it remains a relatively open niche.

Tiered subscription system. Fansly allows creators to set multiple subscription levels, ranging from $4.99 to $499.99, offering more flexibility in monetization. You can offer fans:

- A basic plan for $10 with limited content

- A mid-tier for $30 with extended access

- A premium plan for $75 with exclusive content

- A VIP tier for $150–200 with maximum attention and personalized access.

This structure lets creators monetize different levels of audience engagement and spending power, increasing the average revenue per subscriber.

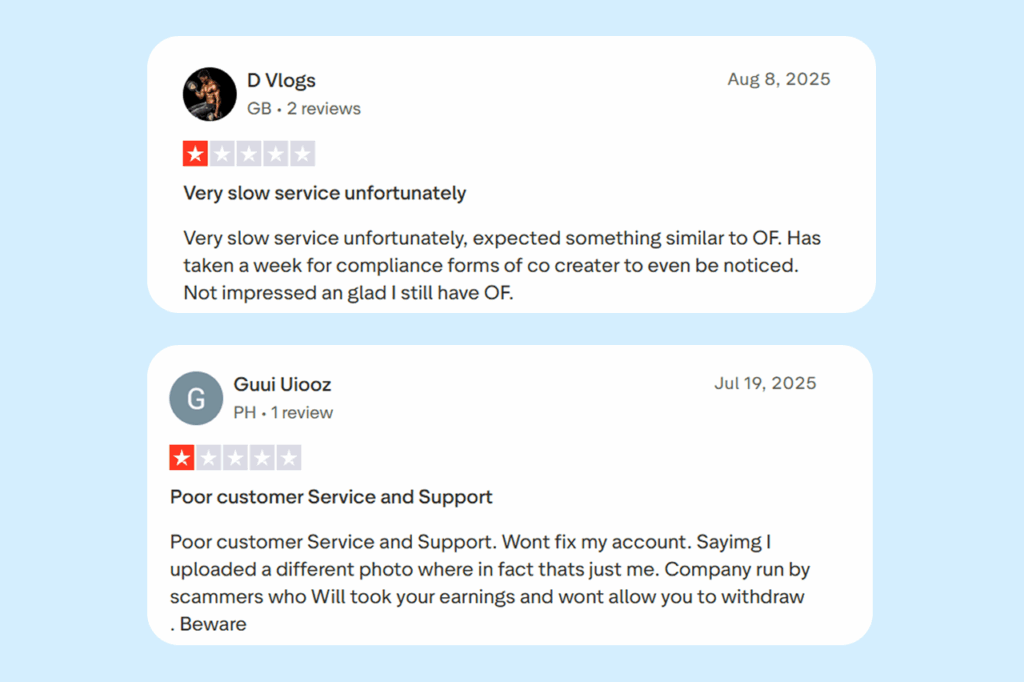

Fast and responsive customer support. Tickets are processed quickly, replies come from real people, and issues are addressed directly. Reviews on Trustpilot confirm that the support team responds promptly and makes an effort to resolve problems right away.

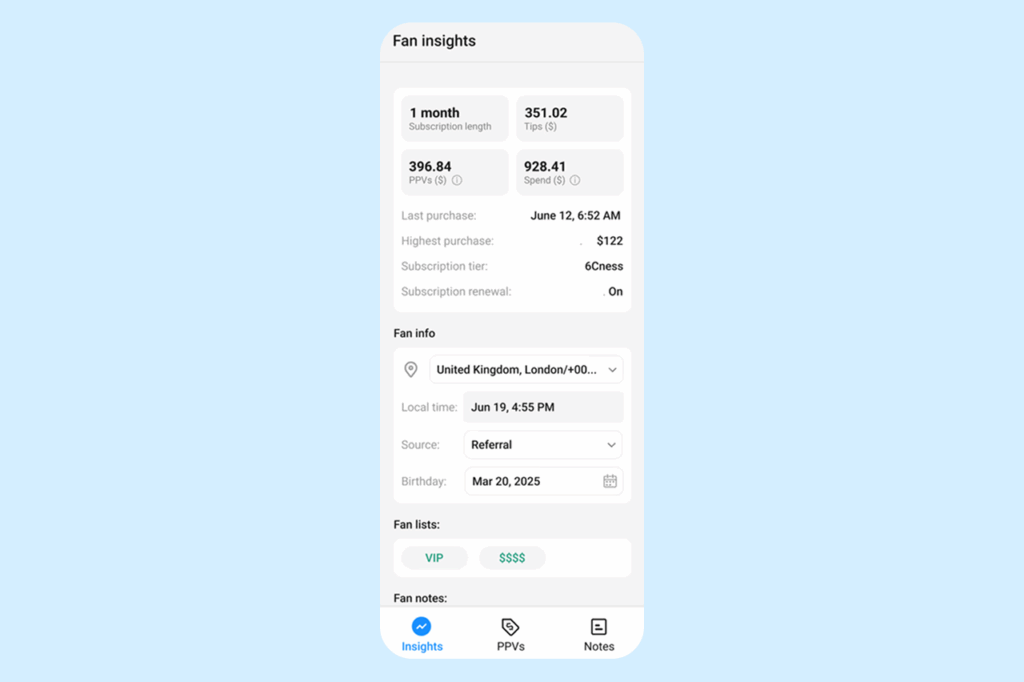

Advanced analytics and tracking. Fansly provides a built-in tracking system that allows creators to generate unique URLs for each traffic source and monitor their performance in detail. You can track not just total clicks, but also conversions to subscribers, average purchase value, retention rates, and other metrics by channel.

Fast payouts. Fansly processes withdrawals within 1–2 business days after the standard seven-day holding period. OnlyFans, by comparison, takes 3–5 days to process payments. With the same holding time to protect against fraud, this means you get access to your funds 2–4 days faster.

Growing reputation. Fansly is gradually building a reputation as a platform centered on more authentic and personal interaction, with less automation and more genuine communication. This appeals to subscribers who have grown dissatisfied with OnlyFans.

Weaknesses of Fansly

Smaller user base. Even with 130 million users, Fansly’s audience is only about 43% of OnlyFans’. This means a smaller potential market for your content. While on OnlyFans it’s theoretically possible to reach hundreds of millions of people, Fansly’s ceiling is lower.

Weaker brand recognition. Many potential subscribers have either never heard of Fansly or are reluctant to sign up for yet another platform. When you share a Fansly link on social media, you often have to explain what the service is and how it works.

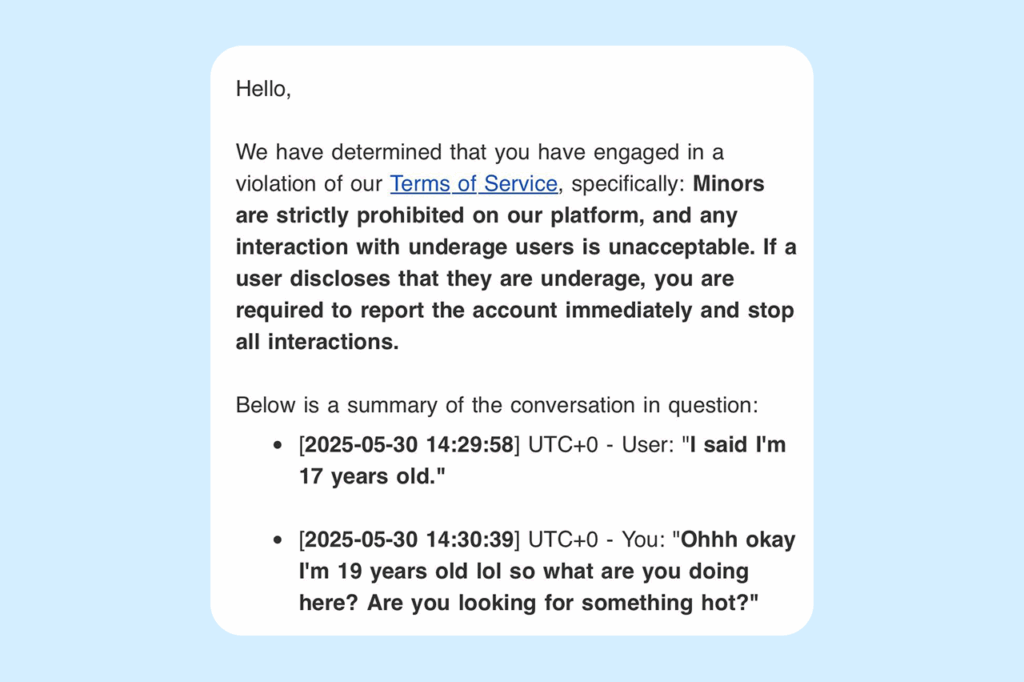

Stricter content policy. In June 2025, Fansly introduced the most extensive policy update in its history. Moderation became significantly tighter, the list of prohibited content expanded, and verification requirements for creators grew more demanding.

Under pressure from payment processors, Fansly has banned or restricted certain types of content, including:

- Any material involving individuals under 18

- Anthropomorphic content

- Public recordings, which now require documentation for every bystander appearing in frame

- Direct AI-based chats with subscribers.

Because of these restrictions, some creators report sudden account suspensions without prior warning.

Verification and documentation issues. Many creators also mention difficulties with the verification process, especially those with nonstandard forms of identification. Strict photo quality requirements for ID, mandatory documentation for every participant appearing in content (even for a second), and rigid file format rules all create bureaucratic obstacles.

Fewer payment options in certain regions. While Fansly supports Paxum, Cosmopayment, SEPA and Wire bank transfers, as well as cryptocurrency withdrawals, payout options may still be limited in some countries. Minimum withdrawal thresholds also vary: $20 for Paxum, $50 for SEPA, and $100 for international transfers or crypto.

Mixed user feedback. Although many Trustpilot reviews are positive, there are also complaints. Users mention slow responses from support, unclear moderation decisions, and overly strict documentation requirements.

Fewer educational resources. Around OnlyFans, a massive ecosystem of training programs, agencies, forums, and creator communities has developed. Fansly, by contrast, it has far fewer such resources. For new models, it’s harder to find reliable guides, strategies, and best practices — meaning they have to experiment much more on their own.

Comparative analysis: figures, facts, and tables

Let’s organize all the data and compare both platforms across key parameters.

| Criterion | OnlyFans | Fansly |

| User base | 305 million | 130 million (43% от OF) |

| Number of creators | 4.1 million | Not disclosed |

| Brand recognition | Global, household name | Growing, but much weaker |

| Internal traffic | None | FYP recommendations + search |

| Competition level | Very high (4.1 million creators) | Much lower |

| Platform commission | 20% | 20% |

| Payout speed | 3-5 days | 3-5 days |

| Payment issues | Frequent: card blocks, delays, freezes | Fewer complaints |

| Support quality | Slow, templated replies | Fast, handled by real people |

| Merch sales | Built-in feature | Not available |

| Stability | 9 years, $6.63 billion in revenue | Younger platform (since 2020) |

| Educational resources | Extensive ecosystem | Fewer materials available |

Fansly offers a more modern set of tools for growth and monetization, while OnlyFans focuses on simplicity and includes the unique advantage of built-in merchandise sales.

The difference is fundamental: OnlyFans is a vast marketplace without navigation, where buyers must find creators on their own; Fansly, by contrast, is a place where content is shown directly to the right audience.

Future of the industry: forecasts and trends

Let’s look at what creators can expect in 2026 across different platforms, considering global trends.

Prospects for OnlyFans

OnlyFans is likely to maintain its leading position for at least the next two to three years, supported by brand recognition, financial strength, and sheer momentum. The platform generates about $1.3 billion in net revenue, giving it resources for continued development and competition.

Possible development scenarios:

- Introduction of its own recommendation system (in response to growing competition)

- Expansion of monetization tools

- Attempts to diversify beyond adult content

- Tightening or, conversely, loosening of content policies depending on regulatory pressure

The challenges: market saturation, declining efficiency of external promotion, and the need to compete with more innovative platforms could make OnlyFans less attractive for creators.

Prospects for Fansly

Fansly is in an ideal growth phase — mature enough to be stable, yet still young enough to scale quickly.

Possible scenarios for its development include:

- Continued monthly growth of 8–12%

- Reaching 200–250 million users by the end of 2026

- Capturing 20–25% of the creator market

- Establishing a reputation as the new industry standard with superior tools

The challenges: stricter policy enforcement under pressure from payment processors, potential technical issues as the platform scales, and competition from emerging platforms may slow growth.

If current trends continue, Fansly could catch up with OnlyFans in the number of active creators within three to four years, though the overall audience gap will likely persist longer.

Final recommendations: what to choose in 2026

For most creators, the optimal strategy in 2026 will be to work on both platforms simultaneously. This combines the scale and recognition of OnlyFans with the organic traffic and advanced tools of Fansly. Diversification has shifted from an optional advantage to an absolute necessity.

The key takeaway: don’t miss out on Fansly. While the platform is still in its growth stage and competition remains relatively low, early adopters gain the greatest benefits. Two to three years from now, when everyone joins, it may be too late.